Institutional and Retail Growth, the $109,000 mark, Bitcoin—the world’s biggest and most well-known cryptocurrency—has reached its highest value recently. This explosive rise changes investor mood and validates Bitcoin’s status as a pillar of the modern financial scene. Bitcoin vs. Gold Peter is being welcomed as both a speculative investment and a defence against economic volatility, as geopolitical concerns relax and world markets steady themselves.

This price point emphasises growing hope in digital currencies and the growing interaction between conventional financial systems and distributed digital assets. For legislators, experts, and investors equally, Bitcoin’s record value points to a new phase of monetary change.

Bitcoin Gains From Global Trade

Resolving global trade disputes, particularly between the US and China, is one of the main macroeconomic drivers of Bitcoin’s rise. Both countries have recently participated in cooperative talks, lowering necessary tariffs and restarting previously halted import-export alliances. Global equity markets have thereby rebounded, and investor risk appetite has grown. Usually considered a digital safe-haven asset, Bitcoin is now benefiting from this changed attitude. Historically, the Crypto Market has been seen as a hedge in times of ambiguity. However, it is now seen as a growth advantage in times of stability.

Bitcoin’s response to lower economic friction points led to its development beyond a reactive asset class and becoming a proactive part of diverse portfolios under institutional investors’ control.

Institutions Propel Bitcoin’s Historic Surge

Big institutional players are a primary driver behind Bitcoin’s surge beyond $109,000. Asset management giants BlackRock, Fidelity, and ARK Invest have explicitly welcomed Bitcoin exposure through investments or Bitcoin-related financial products like trusts and spot ETFs. Recent filings with the U.S. Securities and Exchange Commission (SEC) show that rising flows into these funds point to general investor optimism. Under their corporate treasury strategy, companies like MicroStrategy—led by Bitcoin enthusiast Michael Saylor—continue to amass BTC, further strengthening the “digital gold” story.

> Furthermore, sovereign wealth funds in nations including Singapore, Norway, and the United Arab Emirates are diversifying into Bitcoin, indicating that BTC is no longer an outsider asset but a growing pillar of global finance.

Furthermore, sovereign wealth funds in nations including Singapore, Norway, and the United Arab Emirates are diversifying into Bitcoin, indicating that BTC is no longer an outsider asset but a growing pillar of global finance.

Retail Investors Fuel Bitcoin Frenzy

Retail investor interest explodes as Bitcoin approaches psychologically essential levels. Trading volumes, user sign-ups, and wallet activations are skyrocketing on sites like Coinbase, Binance, and Kraken. With Bitcoin again leading discussions on X (previously Twitter), Reddit, and TikTok, the phenomenon of FOMO ( Fear of Missing Out) is fast spreading over social media channels.

Educational materials like explanation videos on Bitcoin, blockchain technology, and cryptocurrency investing are hot on YouTube and podcasts. Though with one significant difference—today’s average investor is more knowledgeable, has better access to financial instruments, and is less prone to panic sell amid volatility—this digital gold rush reminds me of the tremendous ascent of 2017. Simplifying crypto exposure, platforms including PayPal, Cash App, and Robinhood help to democratize access and promote worldwide adoption.

Macroeconomic Shifts Favour Bitcoin Investment

Beyond conjecture, macroeconomic reality is guiding investors toward other value sources. Bitcoin is becoming a deflationary asset as U.S., European, and Asian inflation exceeds central bank targets. Its regular issue schedule and 21 million coins make it a viable alternative to quantitative easing-devalued fiat money.

Furthermore, recent Federal Reserve recommendations indicate that near-term interest rate increases are unlikely. This dovish posture and slow bond rates push investors to look for assets with better yield or inflation protection. With no link to conventional asset classes, Bitcoin is increasingly filling that function in institutional portfolios.

Bitcoin Network Strengthens With Upgrades

Not that the Bitcoin network itself has been stronger. A crucial indicator of network security, the hash rate has hit all-time highs, suggesting strong miners’ involvement and faith in the system’s lifetime. Technological changes like Lightning Network enhancements make faster, less expensive transactions possible, enhancing scalability.

The ongoing acceptance of Bitcoin depends critically on these infrastructure improvements. When scaling problems are resolved, Bitcoin becomes more practical as a store of value and as a medium of exchange, particularly in regions where access to consistent financial institutions is restricted.

Bitcoin Empowers Economies Facing Crisis

Bitcoin provides a lifeline in countries struggling with limited capital controls or inflation. BTC is used in Turkey, Venezuela, and Argentina to send money abroad, preserve buying power, and avoid financial censorship.

BTC bonds, mining partnerships, and legal tender rules are being tested in El Salvador and Bhutan. The global banking system is beginning to see Bitcoin as an economic empowerment tool in addition to a distributed digital currency.

BTC bonds, mining partnerships, and legal tender rules are being tested in El Salvador and Bhutan. The global banking system is beginning to see Bitcoin as an economic empowerment tool in addition to a distributed digital currency.

Clearer Regulations Boost Bitcoin Adoption

Unlike past bull runs marked by regulatory uncertainty, today’s Bitcoin market profits from clearer legal structures. The recent approval of spot Bitcoin ETFs by the SEC in the United States marks a turning point. Without having to self-custody or handle private keys, these products give conventional investors a controlled, safe way to have Bitcoin exposure.

Digital asset laws are developing in Europe and Asia; nations like Switzerland, Singapore, and Hong Kong provide clear compliance routes for crypto companies. This increasing regulatory sophistication is lowering entrance obstacles and thereby improving the legitimacy of the crypto sector.

Final thoughts

Although Bitcoin’s ascent to over $109,000 excites institutional and ordinary investors, several critics caution against speculative excess. Many observers believe that Bitcoin’s foundations, usage, and technology are strengthening, creating a structural revaluation of Bitcoin in a post-fiat world. BTC’s status in the global financial system seems safer than ever, whether it rises or falls.

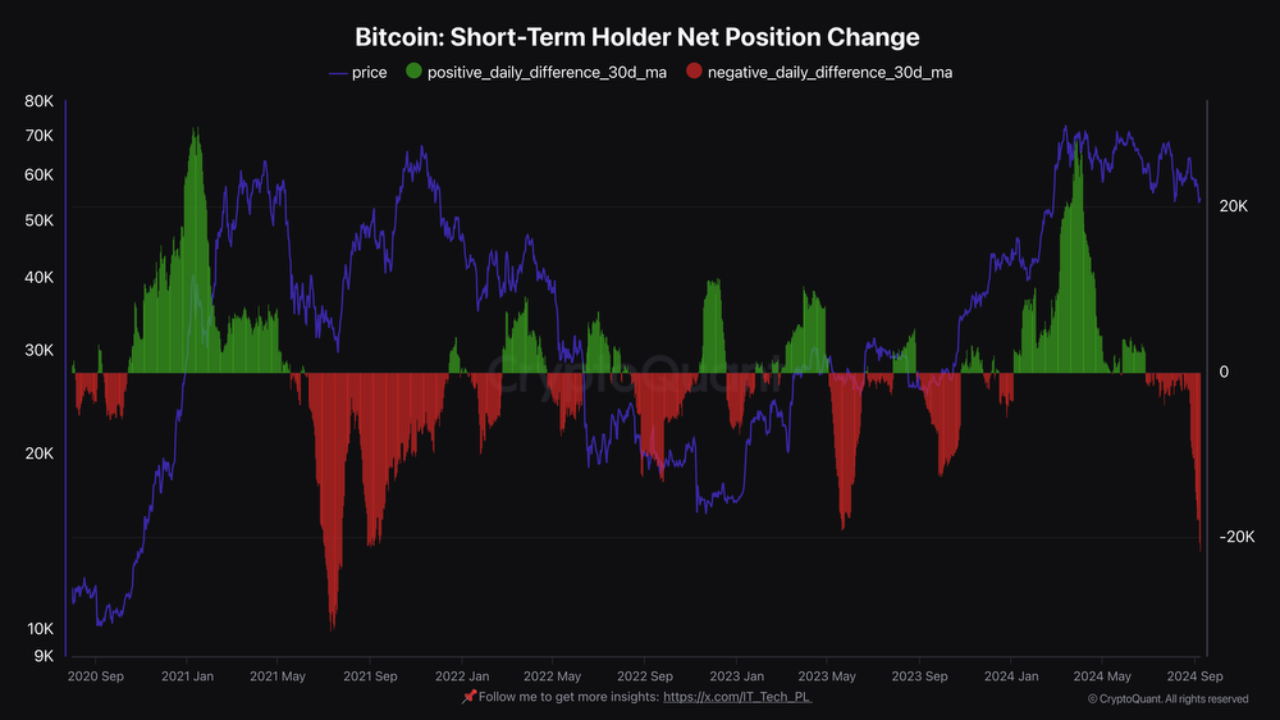

Bitcoin completed a weekly cup-and-handle pattern, a bullish continuation pattern generally predicting significant gains. According to Fibonacci extension levels, BTC might reach $120,000 by late 2025 or early 2026 if it closes over $75,000 with volume. Moreover, market inflows have started to be significantly influenced by Bitcoin ETFs. Institutional capital has poured into the market since the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs earlier this year, validating BTC as a global asset class. Platforms like Grayscale and iShares have attracted billions in inflows, providing fresh pricing support.

Bitcoin completed a weekly cup-and-handle pattern, a bullish continuation pattern generally predicting significant gains. According to Fibonacci extension levels, BTC might reach $120,000 by late 2025 or early 2026 if it closes over $75,000 with volume. Moreover, market inflows have started to be significantly influenced by Bitcoin ETFs. Institutional capital has poured into the market since the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs earlier this year, validating BTC as a global asset class. Platforms like Grayscale and iShares have attracted billions in inflows, providing fresh pricing support. The daily chart shows XRP in a symmetric triangle. Breaking $0.80 would push prices above $1.50 and $3 in a strong bull market. Following previous trends, XRP rose from $0.30 to $3.00 during the 2017 bull run. Whale accumulation exceeds 10 million XRP wallets. Rising demand tightens supply and decreases currency reserves, leading to increasing prices.

The daily chart shows XRP in a symmetric triangle. Breaking $0.80 would push prices above $1.50 and $3 in a strong bull market. Following previous trends, XRP rose from $0.30 to $3.00 during the 2017 bull run. Whale accumulation exceeds 10 million XRP wallets. Rising demand tightens supply and decreases currency reserves, leading to increasing prices.

Geopolitical unrest, including continuous wars in Europe and the Middle East, has undermined faith in conventional economic institutions even further. This unstable environment has pushed money into non-sovereign assets, establishing Bitcoin as a consistent substitute for both gold and fiat money.

Geopolitical unrest, including continuous wars in Europe and the Middle East, has undermined faith in conventional economic institutions even further. This unstable environment has pushed money into non-sovereign assets, establishing Bitcoin as a consistent substitute for both gold and fiat money. These events point to a time when Bitcoin will be more than just a digital asset; it will be a geopolitical tool capable of changing national inflation control, foreign reserve management, and international trade policies.

These events point to a time when Bitcoin will be more than just a digital asset; it will be a geopolitical tool capable of changing national inflation control, foreign reserve management, and international trade policies.